(Disclaimer: Excel file attached below the post)

I recently got done reading "Dethroning the King" by Julie Macintosh and have been grossly contemplating how companies rise to power, are considered the paragons of their industry, and then just as quickly, lose touch with reality, their consumers, and just altogether, loose the will or the appetite to maintain their market share or brand. I initially wanted to talk about the unholy relation between corporate governance and corporate cycle and company valuations, but I opted to shelve that thought and write about something that is directly relevant to what I read: the rise and potential fall of yet another American corporate icon, Intel.

Up until the recent past, Intel was a part of my investment portfolio, but I decided to severe ties with the company right after its earnings call for FY 2023. It had completely vanished from my thoughts until a couple of weeks ago when news about a potential takeover of the company by Qualcomm (QCOM) started circulating the various news outlets and I rendered it serendipitous that this was all occurring when I was reading a book about the rise and fall of A-B. Given my piqued interest and curiosity, I decided to look at the company's financial statements, its current valuations, and of course, what a deal between Qualcomm and Intel could look like. Without any further ado, lets dive right in.

Intel

Ghosts of Intel's Past

Intel- 2023 10K

Founded in 1968 by Gordon Moore, Bob Noyce, and Andy Grove, Intel has long been one of the leaders of the technological advancement over the last few decades as well as being the pinnacle of designing and manufacturing chips, processors and various other products and services that were pivotal to the convenience of the end consumers. The company's rise and long standing leadership during the 80s, 90s, and to some extent in the 2000s, is something that should be studied and applied to companies in their early growth stages, but the company seems to have lost its touch over the last decade, especially the last few years, and before we delve deeper into some of the reasons for its decline and potential demise, I think we should take a few minutes to mull over its performance over the last few years and see if we can see the decline in the numbers.

Over the last 10 years, Intel's revenues have gradually been declining for reasons that we will address later in the post, while at the same time, its Capex (as a % of its total net revenues) has risen over the same time period. Company's capex for FY 2014 was $10BB (18% of total net revenues), and in FY 2023, the company reported capex of almost $25BB (46% of total net revenues). Although the company's capex have risen over the last decade, its revenues have actually declined and margins, both gross and operating, have contracted. Speaking of its margins, Intel had fairly consistent and decent operating margins (anywhere from 25%-30%) for most part of the last decade, right up until FY 2021, and after that things have gotten sour to say the least. Intel reported operating margins of 3.7% on total net revenues of $63BB for FY '22, which resoundingly means that the company's competitive edge, its economic moat, and unit economics have worsened; the company had to spend so much on COGS, R&D and MG&A that even revenues of $63BB- a topline number that I might add, companies would kill for- yielded meager operating margins of 3.7% and gross margins of 42%, where the company posted gross margins in excess of 50% for the preceding three fiscal years in '19, '20, and '21.

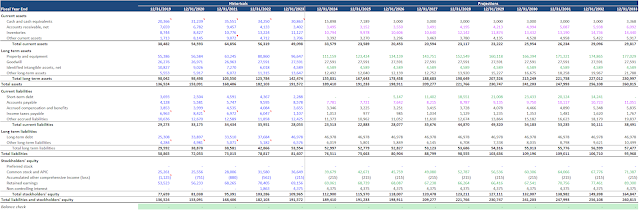

In order to get a clear picture of the company's performance and its gradual fall from grace, I think that we should look at its historical financial statements and try and assess if we can spot the usual suspects in the numbers. As such, here is a look at the company's income statement for the last five years from FY '19- FY '23:

Intel reports revenues in various different segments, and as we can see, the company has been witnessing a gradual and perpetual decline in most its segments. In FY '19, the company reported total net revenues of $72BB and that number has plummeted down to $54BB at the end of FY '23. Moving on to the cost of sales, or more colloquially known as COGS, have actually risen; company reported cost of sales of $30BB (41% of total net revenues) for FY '19, and during the next five years, even though its revenues have gone down, its cost of sales have actually grown to $32.5BB (60% of total net revenues), signifying that at sometime over the last five years, Intel has lost its economic moat and, consequently, its unit economics have all but drowned. This decline in revenues and the proportional increase in cost of sales has yielded worsening gross margins over the last five years; company reported gross margins (considered by many to be the proxy for a company's unit economics and economies of scale) of 58.6% for FY '19, and fast forward to FY '23, company reported ailing gross margins of 40%, further highlighting its incremental decline in the markets and the industry.

Moving over to operating expenses (R&D, MG&A, and occasional Restructuring Charges), Intel's operating expenses have skyrocketed similar to its cost of sales. For FY '19, the company reported operating expenses as a percentage of total net revenues of 28%, and in its latest fiscal year FY '23, the company had operating expenses margins of whopping 40%. Lastly, its NI tells a similar story; Intel's net margins have decreased from 29% in FY '19 to mediocre 3% for FY '23. The company's decreasing revenue growth, increasing cost of sales and humongous increase in its operating expenses tell a tale of company that is very much at the end of its proverbial life cycle. Before moving onto the next section of my analysis, I would like to take a few seconds and talk about the company's cash flow statement for the last three years, only because I believe it will give a real inside view of the cash inflows and outflows of the company, and we might even see positive cash flow despite the poor margins and profitability.

As we can see, company's cash from operations (which starts with NI and adjusts for non-cash expenses and the changes in working capital items) have seen commensurate decline along with its revenues and margins, and that is not a surprise because the starting line in cash from operations is the NI from income statement. Additionally, Intel had positive free cash flows (cash from operations minus capex) in FY '21, but given its massive restructuring and expansion efforts under Pat Gelsinger, the company's free cash flows have been negative for the last two years. Other honorable mentions here would be the fact that Intel repurchased shares back in FY '21 and then suspended their decision to repurchase any shares for the next two years as well as scaling back their dividends; these two could either be perceived as a good thing because it means that the company is reinvesting in order to regain it leadership role in the industry or it could also mean that the company is not profitable enough to generate cash flows that can sustain share repurchases and future dividends.

Ghosts of Intel's Present

Before we move onto some of the reasons, according to my research and understanding, for Intel's decline in revenues, margins and profitability, I think that in order to set a baseline, it is imperative that we discuss its latest operating year in more detail, as I suspect it will divulge more information that will come in handy for my analysis down the road.

I think that the image above, taken from Intel's 2023 10K best summarizes the company's performance over the last year, and as you can see, it is shouting all sorts of troubles. Over the latest fiscal year, company's revenues have declined due to lower revenues from CCG (Consumer Client Group), DCAI (Data Center and AI), and NEX (Network and Edge) segments; we will discuss the segments in more detail down the road. Company's both GAAP and non-GAAP gross margins declined YOY due to increased unit costs, lower revenues, and higher excess capacity charges, the reduction was somewhat offset by the sale of its existing inventory, lower inventory purchases and lower product ramp costs. Moreover, both GAAP and non-GAAP EPS were down YOY due to lower gross profits driven by lower revenues and higher costs and partially offset by relatively lower operating expenses and a higher tax benefit (tax benefit without which the company would have reported negative NI). Lets now discuss the segments in more a little more detail; the company reports revenues in the following segments: CCG (Client Computing Group), DCAI (Data Center and AI), NEX (Network and Edge), Mobileye, and Intel Foundry Services.

CCG (Client Computing Group)

CCG or Client Computing Group is by far the biggest source of revenues for Intel. For instance, for all of the last five observed years, CCG has constituted for more than 50% of Intel's total net revenues. Intel's CCG group engages in products and developments that are mainly utilized in PCs through companies such as DELL (19% of Intel's total revenues), HP (10% of Intel's total revenues), and Lenovo (11% of Intel's total revenues). Under the auspices of this group, Intel has launched the industry's first AI PC Acceleration Program to help enable AI on more than 100 million PCs through 2025 as well as launching 13th Gen Intel Core mobile and select desktop processors, Intel Core 14th Gen Processors, and Intel Core Ultra Processors.

Intel's 10K

Revenue within the CCG group is further divided into Notebook, Desktop, and Other categories, and as you can see, overall revenues for the group have declined due to a decrease in demand for notebooks and desktops as well as lower demand for wireless and connectivity products.

DCAI (Data Center and AI)

Data Center and AI (DCAI) is the second biggest source of revenues for Intel; the company reported DCAI revenues of $26BB (32.7% of total net revenues), $19BB (30% of total net revenues) and $15.5BB (28.6% of total net revenues) for FYs '21, '22, and '23, respectively. This group delivers cutting edge work-load optimized solutions for cloud service providers and enterprises along with silicon devices for communication service providers. The group has sold more than 2 million 4th Generation Intel Xeon Scalable processors as of the end of FY '23, and 5th Gen Intel Xeon processors in the fourth quarter of FY '23. Furthermore, the 4th Gen Intel Xeon processor was recognized by MLCommons which stated that the processor is a compelling invention that competes on performance, price and availability with its competition in the AI markets.

Intel's 10K

Revenues for the segment decreased YOY by $3.9BB due to a decrease in demand in the CPU data center market; this decrease could be attributed to increased competition from NVidia (through its GPUs that are powering the artificial intelligence services) and AMD (through its encroachment of the PCs and data centers' processors and CPUs).

NEX (Network and Edge)

NEX is the third largest source of revenue for Intel; the company reported $4BB (5% of total revenues), $9BB (14% of total revenues), and $6BB (11% of total revenues) for FYs '21, '22, and '23, respectively. This group provides and delivers products and services that helps Intel's consumers improve their operations and protect their data on the Edge through AI driven automation. The company launched 4th Gen Intel Xeon processor with Intel vRAN Boost, and announced the Intel Xeon D-1800 series and the Intel Xeon D-2800 series processors that are optimized for cloud, edge, and 5G networks.

Revenues for the segment were down by almost $6BB on YOY basis due to lower demand driven by the macro events of the last year.

Mobileye

Mobileye is Intel's autonomous vehicle and related technologies division, and develops products and services for autonomous driving and related solutions. The company reported $1.3BB (1.8% of total net revenues), $1.9BB (3% of total net revenues), and $2BB (3.8% of total revenues) for FYs '21, '22, and '23, respectively. Mobileye launched EyeQ based systems into approximately 300 different vehicle models and built significant traction with other products in the company's portfolio. Mobileye SuperVision is continually being delivered on the air in order to improve highway driving and navigate-on-pilot capabilities.

Even though Intel has been working on delivering autonomous driving related products and services for over 20 years now, it only recently started reporting for this segment after it acquired Mobileye back in 2017 and its subsequent IPO in 2022. Revenues for this segment increased by $210MM due to the increased demand for EyeQ products and Mobileye SuperVision.

Intel Foundry Services

Intel's foundry services works with other companies and firms in order to manufacture chips that are designed by its business partners and are specifically tailored for their needs. One of the things that management realized over the years is TSMC's monumental growth given its manufacturing of products that are designed by its clients, instead of designing and manufacturing chips and other products in house and selling them to clients, and in order to compete, Intel started its own foundry business in the last few years and it is very much still in its nascent years, as evidenced by the revenues and consistently negative operating income below.

Intel's 10K

This segment reported revenues of $952MM, an increase from $895 it reported last year. Due its infancy, this segment has gargantuan future growth potential given what other foundry businesses have been able to do as well as the increasing costs and investments that come with growth.

The Dog Ate My Homework

With an understanding of the company's financials for the last decade, and the last year in more detail, I think that I am ready to move onto some of the reasons why I think the company has been putting sub-par numbers, to put it mildly, in the recent years.

Complacency Driven by Magnanimity:

One of the many reasons why empires (i.e., Roman, Carthage, Persian, Greeks, and Ottoman to name a few) failed is their complacency and it is no different for companies and corporations after they reach a certain point. There is a valid reason as to why corporations are legally treated as citizens because they behave in much the same way, and I believe that Intel suffered from the same ailment. The company was quite literally on top of the technological world and its processors were synonymous with the Windows operating system; I remember when discussing new computers and laptops, the first question that was asked was "what Intel processor does it have?" The version of the processor was how consumers used to determine if it was a newer model or an old relic, and that has since changed, for many reasons, complacency being one of them. When companies reach the pinnacle of their cycle, they tend to enjoy the high instead of looking at the future.

There have been so many examples in the corporate world that have suffered the fate that many might think seems like an eventuality for Intel; think IBM, Blockbuster, and Toy's 'R' Us, and is there something that the management at Intel could have done to better position themselves? Yes. The company's R&D and capex have inversely ballooned in relation to its revenues and that should make one wonder where all that capital was being deployed. Intel for the most part of its tenure has been a designer and a manufacturer and so the R&D expense, in many ways, fueled the management's lack of foresight. Their myopia, in hindsight, is quite vivid because it seems like the capital they deployed has been for new iterations of their existing repertoire of products and services rather than ground-breaking new technologies. I say this because given its place in the industry, I believe Intel should have been the one at the forefront of artificial intelligence and the mania surrounding it rather than an underdog like NVidia, which at the time of this post, is the second most valuable company with market cap slightly below that of Apple's.

Lack of Risk Taking

I mentioned at the beginning of the post that one of the reasons why I decided to do this is due to the fact that I just finished reading "Dethroning the King", and the book goes in excruciating elucidation into A-B's lack of risk taking and how that contributed to it being taken over by a company that stemmed from Brazil and that A-B, at one point in time, had the opportunity to acquire. Lack of risk taking would be the second reason why I think Intel is in the place that it is in; management was, I suspect, quite comfortable enjoying the position that the company was in and, I suspect, did not see the point in taking risks and exploring new ways of expansion and relevance. I will mention two examples here: one that of autonomous driving and the second of the foundry business.

Intel touts in its latest 10K that it has been invested in autonomous driving related products and services for over 20 years, and yet they took the step to acquire Mobileye in 2017. If the management had the appetite for risk and the yearning for future growth, they would have taken the initiative well before 2017 and taken advantage of the situation when the markets were putting a premium on companies within the electric and self-driving categories. The second example of the foundry services pretty much paints the same image; Intel was so insulated in designing and manufacturing its own chips that what other firms like TSMC and Samsung were doing seemed to be of no consequence and as a result, Intel lost valuable market share to those companies due to their ability to not only manufacture chips and processors built by their clients but also improve them through testing. Intel started its own foundry services a few years ago in order to compete with companies like TSMC and Samsung, and it might be too little too late because now they have to engage in competition on two fronts: Intel not only has to compete for its foundry business with well established aforementioned companies but it also has to compete with the likes of NVidia (who gets its manufacturing done primarily by TSMC) in terms of designing and building GPUs and accelerators that are required for AI and related products and services. Will Intel's foundry business see the success that TSMC is enjoying? Only time will tell, because they will have to not only outperform TSMC and Samsung but also incentivize companies to engage their services instead of TSMC and Samsung. This begs an even bigger question, will they be able to compete on such a large scale when they are also being pummeled in the AI field by NVidia?

The Business

Another reason that I can think of is the industry that the company is in; this particular industry witnesses rapid technological, geopolitical, and market developments and it becomes hard for an individual company to stay abreast with the ever changing needs of companies, the clients, and consumers and their unpredictable and capricious spending behavior and habits. lets look at CCG and DCAI in order to understand how rapidly the industry needs change and how, understandably, hard it is to stay on the top. The Client and Computing Group engages in products and services that are catered for laptops and PCs through the company's partners, and this segment has been gradually declining due to consumers veering towards tablets and mobile phones with ginormous screens. Given the change in consumers' behavior, laptop and desktop manufacturers have scaled back their demands in order to not only sell their current inventory but also take lower reserves for the future; this is one of the major reasons for the decline in this particular group. DCAI or Data Center and AI engages in CPUs and other products that are specifically designed for data centers and we can all guess the tectonic shift in that group: data centers are now in need of GPU accelerators that are designed by NVidia and manufactured by TSMC and their need for CPUs that Intel used to deliver is rapidly deteriorating. The sudden changes are unpredictable, yes, but not at all surprising because that is the business the company is in, if they are unable to predict the future demand then perhaps they should focus on buying instead of trying to achieve the impossible, that for intents and purposes, the company seems incapable of doing. Additionally, Given the fact that CCG and DCAI accounted for 54% and ~ 30%, respectively, of the company's total net revenues for FY '23, Intel will have to figure out an avenue to turn things around in these segments if they wish to stay relevant.

Geopolitics

Intel's 10K

Majority- almost 73%- of the company's total net revenues are generated outside of the US, and China, without any consternation, is the company's biggest country in terms of billing and revenues. As we can see, US's policy of preventing advanced technologies being delivered to countries that it considers hostile, namely China, is now showing up in the numbers for companies that engage in international affairs. Intel reported revenues of almost $23BB for FY '21 from China, and that number, two years later, is now down to almost $15BB. Another aspect of geopolitics would be that countries, as a result of supply chain bottlenecks and resulting inflation during Covid, are now focused on onshoring a lot of the manufacturing of chips, processors along with other goods and services. US is one of those countries and the current administration put forward a lofty plan to bring chips and processors' manufacturing back to the States, and Intel has been the primary benefactor of this initiative. There are pros and cons to what transpires in the political sphere but an ideal situation would be that the US and China are again on friendly terms which would, without a doubt, yield better numbers for the company.

Market and Expectations

Another reason that comes to mind when looking at Intel is the market and its expectations. Equity investors inherently are focused on future growth- as opposed to creditors and lenders that are primarily focused on the past- and if the markets suspect that the company has fallen back, it gets punished for it, regardless of how effective the company has been in the past. To put things in perspective, Intel's revenues declined, for reasons mentioned in this section, by 14% on YOY basis and still reported $54BB, a number that majority of the publicly listed companies would quite literally kill to attain, and yet it is trading, for the first time in decades, below its book value (assets minus liabilities). I believe a large reason for this is that investors are now attributing very little market share of the mammoth AI industry to Intel even though its perfectly suited and positioned to attain a sizable chunk of it.

Side note: I remember when Apple released its first iPhone and it quite literally decimated other companies such as Blackberry, Nokia and Sony Ericson, but it also resulted in new technology coming into the markets that yielded even bigger players such as Samsung, Xiaomi, and Huawei. So, yes, Intel might not have the first mover advantage in terms of the AI and related products and services, but it definitely stands to benefit from the industry's infancy and massive potential growth in the future.

Valuation

Base case assumptions

- Client Computing Group (CCG)

- The company reported $29BB (54% of total net revenues) for this segment in FY '23, and I expect this segment to remain relatively flat for the next five years where I suspect it would be around $29BB by the end of FY '28 or 52.5% of total net revenues. However, I do see growth in this segment after five years and I expect that the revenues would then increase to around $39BB by the end of FY '33, but as the company grows its other segments, CCG, by the end of FY '33 will reduce to being ~45% of total net revenues. I see the growth in this segment majorly driven by increased demand in the PC industry given that it should rebound in the coming years. PCs are also still majorly prevalent in the corporate world and that stands to increase over the next decade due to a mixture of new orders as well as replacement ones. Furthermore, I believe that AI related activities should also give a boost to PC's demand not just in the USA but also worldwide. I expect the growth in this sector to be offset by competitive products such as the Macs, cell phones, and tablets of the world.

- Data Center and AI (DCAI)

- The company reported a reduction in revenues for this segment of 19% or $15.5BB for FY '23. I expect the revenues for this segment to go through further contraction over the next five years, and by FY '28 should be around $3BB. I see this reduction due to clients focusing their needs on GPUs and products that Intel does not have a competitive edge or the first move advantage in. But, as the company continues to invest in the coming years, I believe that this segment will then again see good days and start to improve by FY '26 (I wouldn't be surprised if it improves before then). I expect revenues for this segment to be around $21BB (25% of total net revenues) by the end of FY '33.

- Network and Edge (NEX)

- Intel reported revenues of $5.7BB (10.6% of total net revenues) for this segment by the end of FY '23, a reduction of 35% YOY basis. Given the change in cloud to edge, I expect this segment to again turn positive over the course of next five years. Given the saturation in this segment, I am not seeing monumental growth but only decent where revenues in FY '28 should be around $3BB, and as the company develops its products, services, and relations within the industry, revenues should start to pick up and end the decade on a good note; I expect revenues for this segment to be around $4BB (6% of total net revenues) by the end of FY '33.

- Mobileye

- Intel reported $2BB (3.8% of its total net revenues) in revenues for this segment which was an 11% increase from the previous year's reported number of $1.9BB. Given the demand and interest in autonomous vehicles, I expect revenues for this segment to increase to about 25% by FY '28, or $5BB (9% of total net revenues). As the industry gets more saturated and the company looses its edge and maybe even market share, I expect this segment to be at ~$12BB (14% of total net revenues) by the end of FY '33.

- Intel Foundry Services

- Intel reported revenues of $952MM (1.8% of its total net revenues) for this segment for FYE '23. I expect this segment to grow to 20% to ~$2BB over the course of the next five years, and as it solidifies its place in the industry, I expect revenues for this segment to end at around $4BB (5% of total net revenues) by the end of FY '33. I understand that this is one of the hardest segments that Intel has to strive in in order to improve their market share due to leading competitors such as TSMC and Samsung; and with the understanding that the company has been investing heavily in the last few years in order to improve this segment, my assumptions do not seem implausible. In fact, I believe that this segment has the potential to outperform my assumptions by a long margin, it all depends on how sanely the company invests its capital and how effectively they'll be able to implement their strategies.

- Cost of Sales

- One the reasons, along with reduction in total revenues, why Intel's margins have contracted over the last few years has been due to their ginormous cost of sales; for instance, the company reported $35BB (45% of total net revenues), $36BB (57% of total net revenues), and $33B (60% of total net revenues) for FYs '21, '22, and '23, respectively. Given that the company is going through a restructuring of its business model and financial strategies, I expect cost of sales to continue to be a significant part of its total revenues. I expect cost of sales to settle around 55% ($30BB) of total net revenues by the end of FY '28. After FY '28, I suspect that the company should begin to see the fruits of its labor, and as a result, cost of sales should gradually reduce to about 45% ($39BB) by the end of FY '33.

- Operating Expenses

- Operating expenses, in conjunction with the reduction in revenues and increase in cost of sales, have also increased at an almost exponential rate over the last 5 years. Intel reported operating expenses margins (operating expenses divided by total net revenues) of 31% ($24BB), 39% ($24.5BB), and 40% ($22BB) for FYs '21, '22, and '23, respectively, and given the condition the company is in, I do not see a reason why they should improve. I suspect, given that the company has all but lost its competitive edge, and is nowhere near its competitors, management will have to continue to invest heavily in R&D and MG&A in order to retain top talent and improve their top line through marketing efforts. I expect operating expenses to increase to about $25BB (45% of total net revenues) by the end of FY '28, and as the company gains its footing again, these costs should begin to come down; I expect operating expenses of $24BB (28% of total net revenues) by the end of FY '33.

- Operating Margins

- Given my assumptions about the revenues, cost of sales, and operating expenses, I expect margins to be non-existent for the next five years (a long cry from 30% margins the company reported in FY '19). But, here is the kicker, as Intel gains a foothold, as markets and investors start to favor the company, and as it gains a share of the AI industry, I expect margins to improve sometime after FY '28. In my base case, I expect operating margins to be around 27% by the end of the projection period.

- Capex and Reinvestment

- Capex, no surprise here, has also risen over the last five years, company had capex margins of 47.5% for FY '23, which given its current restructuring and reorganization plan is not that astonishing. I expect capex to gradually decrease over the next 10 years to 25% by the end of FY '33.

- WACC

- Given a after-tax cost of debt of 3.90%, risk free rate as of this post of 4.03%, Intel's beta of 1.26, and the market risk premium of 3.96%, I got a WAC of 8.05%.

- Other Factors

- Other factors that might impact the company's future are as follows:

- The company might end up of divesting or carving out some parts of its business which would lead to a different valuation, I have not taken this into account.

- If the company continues to pay dividends- my model predicts that the company does not have enough cash flows to support it- it will see negative impact on its cash flows.

- The management might be able to effectively implement its new plan and strategies which would result in a turnaround and might yield a higher valuation given the increased potential of future cash flows.

- Company might be able to gain a bigger share of the foundry business than what I have assumed.

With these assumptions in place, here is a look at Intel's three statements, relative projections, and the valuation.

Starting with the income statement, I expect total net revenues to continue to decline for the next five years due to my assumptions above, and after the "investment" period, which is the next 5 years, I expect total net revenues to pick up again and end the projection period, FY '33, with $86BB in total net revenues. I also expect the company's margins to be uninviting for the next five years, but I believe will end the projection period on a good note.

I have not assumed any capital raises, debt or equity, and so I expect the company to continue operating at its minimum cash balance due to my projections about line items such as capex and working capital. Given the massive reinvestment, I suspect they will need to raise short-term debt over the next 10 years, but they should be able to repay all of it back by the end of FY '33. My model and assumptions also show me promising improvements in company's retained earnings.

I do expect the company to continue to yield negative free cash flows for the next five years, and as all the variables that I mentioned above improve, the company should generate $22BB in FCFs by the end of FY '33. I think this is as good a time as any to bring the company's valuation in.

In my base case, I get an implied value per share of $38.84 through perpetuity growth method and $33.13 through EBITDA multiple approach, the stock, at the time of this post, was trading at $22.38. I believe that given the company's storied history, its brand name and other intangible assets as well as its future potential, the markets are undervaluing the company. I believe a huge chuck of this discounting can be attributed to Intel being late at the AI game and therefore the markets not allotting it any benefit of the doubt. Yes, AI gravy train has left the station but there is possibility that Intel might be able to pick up the gravy that fell on the tracks.

Sensitivity

Of course, I completely understand that I might be incorrect, or I might be to too heavy or low on some of my assumptions, and so given the variables that I know impact a DCF analysis, here is a look at some data tables that show the share price given changes in some of the variables.

Images 1 and 2 above show the different ranges of share price given modifications in variables such as WACC, implied growth rate, and the terminal year EBITDA multiple.

Images 3 and 4 look at the impact on price per share given changes in operating margins, EBITDA, and revenues in FY '33, and as you can see, the company only needs to bring in around $60BB and 25% margins (the lowest end of the range) in order to justify its current trading price of $22.38.

Qualcomm and Intel

As mentioned at the start of the post, what prompted this post was the news about Qualcomm making a bid for Intel, how true that is or what the terms are is still a mystery and to see what the deal could look like, I have made a few assumptions.

Let me preface this accretion/ dilution analysis with the fact that I believe this deal is close to impossible given the sheer size of Intel and its balance sheet. But, since the news is circulating, I wanted to give it a go and see how dilutive the deal could be for Qualcomm. Qualcomm at the time of this analysis is trading at about 22x its earnings on twelve trailing months basis, and Intel is trading at about 95x its earnings on TTM basis, and just by looking at the P/Es you can tell that there is no way this deal would be accretive for Qualcomm, but lets still jump through the hoops and see what we get.

Qualcomm, at the time of this post, has a market cap based on its fully diluted shares outstanding of about $197BB, and Intel, based on its diluted shares outstanding, has a market cap of just under $100BB. In order to make the deal appealing to the management and the shareholders, Qualcomm will have to make an offer with a premium of about 20%-30% (which is typically the range for control premiums in M&A transactions of this size), and if we assume a premium of 20%, the offer price for Intel would be $27.98, based on its current trading price, and assuming its diluted shares outstanding of 4,382MM, we get an offer value of $123BB, and if we bring in Intel's net debt, we get a transaction value of $145BB. I have assumed that Qualcomm will use 30% stock and 70% cash, and for 70% cash, they will use about 76% of their own cash (~$8.6BB) and raise $77BB in debt, I have assumed that they will refinance Intel's debt, which will increase their borrowings by $49BB. For the sake of argument, I have also assumed asset write-ups for PP&E and Intel's intangible assets, and I got an additional goodwill of $35BB that Qualcomm will have put on its BS. Given my assumptions about the supposed transaction, here is what Qualcomm's balance-sheet could like on closing:

Since I have assumed a massive amount of debt for the deal, the interest expense for Qualcomm going forward could be well around $4BB, and given the amount of cash that I have assumed they will use, Qualcomm will, without a doubt, loose income on that cash. I don't have access to databases such as FactSet and CapIQ and so I have used Intel's NI and shares outstanding using my own standalone model, but for Qualcomm, I had to make a few assumptions in terms of their NI and EPS. I might be off in terms of Qualcomm's NI or future shares outstanding, but I doubt it'll impact the model in any significant way or turn the deal accretive. Here is how dilutive the deal could be for Qualcomm going forward:

As you can, the deal would be about 50% dilutive for Qualcomm for the foreseeable future, and given that it is a publicly listed company and that the management has a fiduciary duty to its shareholders, this deal, under no circumstances, should be entertained. Qualcomm would need to realize total synergies (revenue, capex or cost) in excess of $6BB just to make the deal break-even, a monumental task to say the least. This was assuming a 30% stock and 70% debt, if we assume all cash, the deal would still be massively dilutive given the sheer size of the borrowings and the resulting interest expense. Would making it all stock make any difference you might ask. No, it doesn't, due to the drastic differences in the companies' P/Es.

ConclusionThis analysis was, of course, to satiate my own curiosity, and if you don't agree, the excel file is attached, play with the numbers and see if you can come up with anything different. In conclusion, I would say that Intel is currently being traded far below its true intrinsic value, and there still is plenty of potential for the company in the future, but if you have already made up your mind, then I doubt there is anything about the company or its future that will make you change your thoughts. As for the deal, I do not believe that acquisition of Intel would be a good corporate action for Qualcomm and its investors, but wall street is adept at persuading companies to do stupid shit!

Links:

Intel Valuation- 10/18/2024