(Disclaimer: Excel file attached below the post)

UnitedHealth- Operations and Historic Performance

Before we delve deeper into the company and its operations, I think that the historic stock price of any publicly traded company is a decent barometer of not only the company's performance but also how the markets have perceived it throughout its nascent and maturity years. So I went back 10 years and I gathered UNH's historic stock price and trading volume.

As is evident, UNH is well diversified, but not diversified in the normal sense of the word where a portfolio manager might have holdings spread out across different industries and sub categories, but rather in the sense that the company doesn't only provide health insurance, but also conducts business in every other aspect of the field; it provides analytics, software, consulting, and administrative support through its Optum Insight branch, it not only provides comprehensive patient care through Optum Health, but also has an Optum bank with $20 billion in assets under management, and as expected, it provides pharmacy services through Optum Rx, and health insurance coverage through its UnitedHealthcare branch. Diversification is without a doubt a pro for the company, but how has this diversification played out in numbers over the past ten years? Lets look at its revenue growth, operating income and margins over the last decade.

Lets further peel the onion and understand what revenues are comprised of, and what other metrics look like. UNH breaks down its revenues in the following categories: Premiums, Products, Services, and Investment and other income. Premiums, without any surprise, constitute the bulk of revenues for UNH; Premiums were 79% of the overall revenues for FY '22, followed by 12% for Products, 9% for Services, and 0.6% for Investment and other income. Moving onto other metrics, the company reported NI of $6B with net margins of 4.6%, ROE of 18% and ROIC of 30% for FY '13. Fast forward to FY '22, UNH reported NI of $20B (16% growth YOY) with profit margins of 6%, ROE of 26% and ROIC of 33%. Below is a visual representation of UNH's NI, ROE and ROIC along with its operating income for the last decade.

When valuing a company, any company, I believe there are some questions that the inquisitor ought to ask; Does the company in question have a competitive advantage? Has the company been generating a decent return on its invested capital? Is there vivid growth in both the top and bottom lines? Looking at the historic numbers, I believe that UNH does have a competitive advantage, even if its operating margins have hovered around 7-8%, again, I believe that low margins are because of the industry that it is in and the cost of doing business in it. The company has also been generating a steady amount of ROIC and ROE over the last decade. Looking at one company in the sector does not really help our case, so I decided to look at the market caps of UNH and other major players in the industry over the course of the last five years.

I also went a step ahead and compared UNH to S&P, a mutual fund managed by Fidelity, and an ETF controlled by iShares. Prior to '21, UNH underperformed when compared to S&P and its share price was in line with the mutual fund and ETF managed by Fidelity and iShares, but after 2021, as shown below, the company outperformed S&P as well as both the ETF and the mutual fund.

Before I proceed with the valuation, I think it is prudent for us to understand what stage of the life cycle UnitedHealth Group is in, and for us to fully comprehend that, lets look at the various stages that a business typically goes through.

Having gone through UNH's financial statements, its history, and performance over the last decade, I believe that the company is in its mature stable stage. Its high growth, or even mature growth, days are in rearview mirror, and so I think that going forward, UNH will struggle to put up the revenue growth that it has enjoyed over the course of its aged history. In its present stage, I believe that its top line growth will slowly converge with the general economy- from 12.7% YOY in '22 to 3.4% in '32. For a detailed breakdown of growth in its reported segments, please refer to the file attached below.

I further believe that its operating income will slowly move from 9% in '22 to 8% in '32- driven mainly by its brand name, its long and historic relations, innovation and diversification, and lastly, because everyone needs health insurance. Furthermore, I believe that Capex and D&A will converge over the long run (I know, not a safe assumption given that I have assumed a long term growth rate of 3%), as well as NWC margin working its way down to 10% in '32 from 14% in '22. I have assumed a long term growth rate of 3% which I believe fully encapsulates what the future holds for the company: a company that is at the long tail of its existence, and will only be reinvesting enough for moderate growth in perpetuity. After converting my assumptions into numbers, and running the model, I got a price per share of $562.89; other related numbers can be seen in the image below.

At the time of this valuation, UNH was trading at $526.55. Do I think that the stock is undervalued? Yes, but it is also simply the share price I got based on what I think about the company. It is entirely possible that the market is right and is pricing in what the management has done or expects to do in the future, or maybe the analysts are privy to information that I simply do not possess or have a better understanding of the industry, but nevertheless, I sternly stand by my numbers and narrative. For analytical purposes, I also ran a few sensitivity tests with data tables as well as the Monte Carlo simulation.

Sensitivity:

Image 1

Image 2

Image 3

Image 2

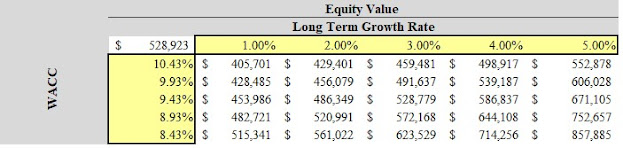

Sensitivity analysis allows us to look at the impact of various factors on price per share, equity value, or really any other item you are trying to sensitize. As such, image 1 shows what the equity value might be given different long-term growth rates and WACC. In my base case assumption of 3% long-term growth rate and a WACC of 9.4%, I got an implied equity value of $528B, but we can see what effect changes in growth rate and WACC might have on UNH's implied equity value. For instance, If I were to assume that the long-term growth rate will be 4% instead of 3%, and WACC will be slightly lower at 8.9%, then we get an equity value of $644B, giving us a higher price per share.

Similarly, image 2 above shows the impact of long-term growth rate and WACC on the implied price per share. My base case assumption of 3% and a WACC of 9.43%, gives me an implied per share of $562.89, but what happens if we slightly change those assumptions? If I assume a growth rate of 4%, given a WACC of 9.14%, I get a price per share of $658.44. Image 3 paints a similar picture; it sensitizes the share price given different revenues and operating margins in FY '32.

To further understand and illustrate how different assumptions could impact the implied value per share, I decided to also run a Monte Carlo simulation and assess how far the values are from the mean assuming a normal distribution.

The usual suspects when valuing a company are the growth rate, operating margins, and the cost of capital. I assumed a 2.5% standard deviation in my growth rate, why 2.5%? Because it is entirely possible that I might be wrong about what stage of the business cycle the company is in, rendering my assumptions about revenue growth rate futile, or that the management ends up generating revenue through other means. I also assumed a 0.50% standard deviation in the cost of capital, because WACC is driven off of macro trends and could deviate from one year to the next. Finally, for my operating margins, I gave myself a standard deviation of 2%, assuming that the margins could be different from what I hypothesized. I ran 10K simulations with my assumptions, and the distributions are as shown above. As you can clearly see, most of the values lie between $540- $580 price per share.

Conclusion:

Based on my narrative and understanding of the company, at $526 a share, UNH is undervalued. My one year price target for the stock is $615.16. With all this being said, this is not meant as an investment advice, because as is clear from my profile, I am not an industry professional. I do this for educational purposes and also to quench my curiosity. I recommend you download the attached file, and change the numbers with what you think about the company and its future.

Links:

No comments:

Post a Comment