(Disclaimer: Excel file attached below the post)

Roku (ROKU) recently reported its fiscal year '23 results, and being one its most ardent consumers, I have decided to value the company and assess its operational history and whether there is any justification for its trading price of $67.25/ share as of the analysis. To start the post off, I think I will briefly talk about Roku's performance over the past few years, how it compares to some of its close competitors as well as some of the vastly followed indices, try and delineate its business model and segments, and then end the post with my analysis and the valuation.

Roku: Operational History

I believe that in order to assess a company's performance, along with other relevant metrics, we need to inspect how the company has withstood the test of time and the tumultuous environment of the public markets, as well as its performance and returns compared to some of the religiously followed indices and its competitors. As such, below is Roku's performance over the past five years compared to S&P and the Nasdaq indices:

Roku (ROKU): Comparison with S&P and the Nasdaq

As you can see, Roku overperformed both the indices from '19 to mid '22, and then we see the gradual decline of the stock. The spike from mid '20-'22 is the period, as far as I can tell, when Wall Street was overestimating growth stocks and assigning unattainable expectations to companies' top and bottom lines. The stock, for the past couple of years, has underperformed and I believe the days of $700/ share are long gone, and any future expectations of that target would prove futile and insurmountable. In order to better elucidate the company's performance, lets look at how Roku has performed in comparison to some of its peers.

Roku (ROKU): Comparison with its peers

As is evident from the image above, Roku has always been the odd duck in the family, at least up until a few years ago. We can see the spike the company witnessed, and we can also attest to the fact that Roku was the only equity that witnessed that spike within the observed group, why is that? I believe the culprit for the skyrocketing of the stock was the expectation attached to it. lets think about how valuations work; a company is valued based on its future cash flows discounted back to the present at a reasonable discount rate, WACC or cost of equity depending on the nature of the cash flows; I believe investors were aligning unattainable growth to the company, and since then, reality has kicked in, and the stock is now trading at a historic low.

Roku: Overview

Roku is the leading TV streaming platform in the United States by hours streamed. The company, since its inception, has invested heavily in its growth, both organic and inorganic, and as a result, has seen growth both in its revenues and users as well as its acceptance into the American fabric. The shift from regular cable TV to streaming and bundled platforms can clearly be seen in the company's growth over the years, and it is only expected to expand as more and more consumers make the shift. The coup has also provided additional opportunities for Roku's management to cease; these new avenues of growth came from more lucrative relations with content partners, increased advertisers, and myriad of other industry participants. Roku reports on two following segments:

- Platform Revenue

- Roku generates platform revenue from the sale of digital advertising and streaming services distribution. Company's ad inventory includes video ad inventory from AVOD content in the Roku Channel, native display ads on home screen, as well as ad inventory the company obtains through streaming services distribution agreements with its content partners. Platform revenue was 85%, 86% and 82% of total revenues for FYE '23, '22, and '21, respectively.

- Devices Revenue

- This segment generates revenue from the sale of streaming players, Roku-branded TVs, smart home products, audio products, and related accessories. This segment also includes revenue from licensing arrangements with various operators. Devices revenue was 14%, 13%, and 17% of total revenues for FYE '23, '22, and '21, respectively.

Strategy

The bedrock of the company's performance is its in-house built Roku OS. Roku OS is purpose built for TV streaming and powers all of Roku's devices. The software is designed to run on low to moderate cost hardware and thus is sold and licensed at competitive prices. The OS fulfills the pivotal task of connecting viewers to the company's platform through broadband network. The access allows users and consumers to choose from a library of vast content. Over the years, the company has spent significant resources to build, maintain, and advance its OS; the investment in the OS has been to gain and maintain its market share, improve its relations with its content partners, attract more advertisers, bring aboard more content, and lastly, to build a rapport with its users that is ever expanding. The company has three step process to grow in the future: grow scale, grow engagement, and grow monetization.

Grow Scale

In terms of its growing scale step of the ladder, the company makes devices- from TVs to cameras and various other video and audio devices- that are affordable and can be sold at competitive prices. Company makes its own branded TVs that are sold by its partners that license its OS. Roku has witnessed strong active account growth through its licensing program, which according to the 10K, the company launched 10 years ago. In 2023, Roku launched Roku branded TVs that are designed, made and sold by the company, therefore giving the company an additional avenue of growth. The TVs are sold through various vendors such as Costco, Amazon, and Best Buy. Roku's branded TVs operate in close proximity with its licensing program and give the company an opportunity to grow its streaming platform through enticing consumers with competitive prices. This avenue of innovation could also lead the company into the higher end of the market where it could be competing with the likes of Samsung. As of the end of 2023, Roku added 10 million net active accounts, consequently, ending the year with 80 million active accounts, a mile stone in its own rights.

Increase Engagement

User engagement is considered one of the most crucial, if not the most crucial, metrics for companies like Roku. Company's ability to engage with users, increase that engagement, and then be able to maintain or even further enhance that engagement is what feeds into the revenues and flows down to the NI, and Roku, unsurprisingly, has been heavily vested on this side of the coin. Roku's wide range of content and easy user interface has led the company to grow its streaming hours from 87.4 billion in FYE '22 to 106 billion by the end of 2023. One of the main reasons for its success has been its place within the streaming landscape and its ability to scale its offerings. The home screen, accompanied with its menu on the left side of the screen, gives users access to a wide variety of content ranging from AVOD, live TV, to premium subscriptions. Company's significant scale over the years, constant innovation and improvement, and highly engaged users make the company a sought after partner for its content providers.

The company also owns and operates its Roku Channel. An app that benefits from its integration with the streaming platform and its various offerings; the app helps in surfacing more content to viewers directly from the home screen and the platform. As of the end of FY '23, the app was one of the top 5 performing apps on the company's platform.

Increase Monetization

Being able to monetize its users and services is existential to the company's present and future growth. Roku generates revenues through sale of digital advertising and content distribution services. The more users the company has, the more engagement it is able to generate, and the more it would be able to generate in terms of ad and content distribution revenues. Roku's streaming platform enables content partners and advertisers to reach consumers that they otherwise might not be able to; each user on the company's platform is a potential avenue of growth and revenue.

The company makes it possible for its content partners to reach their intended audiences through SVOD (subscription video on demand), AVOD (ad support video on demand) and FAST (free ad supporting streaming TV). Roku's vast library of content and supporting offerings make it possible for its content partners to attract, maintain, and engage viewers. Ads on Roku's platform are more evolved than traditional TV as the platform provides access both online and offline; the platform makes its feasible for consumers and reviewers to click an ad and open the app or even consume TV and movies. Roku also offers its content partners access to its proprietary billing services for in app rentals and subscriptions as well metrics such as impressions, video completion rates and click-through rates.

With, what I think is a sound understanding of the company's operations and its business strategy, I think we are at a solid leverage point to move on to the analysis and valuation.

Valuation

As is the custom with my valuations, I'd like to start this leg of the journey with an overview of the corporate life cycle.

Roku is a growth company and so it displays the stereotypical attributes that investors expect from growth equities, namely, high revenues, high costs, low or negative operating income, amalgamated with higher cost of capital. I believe the path to profitability, positive operating income, is short and not as long as some of the articles online have suggested. Based on what I understand about the company, I believe that it is in the teenage stage of the cycle, and as it suggests, I believe, as the company moves forward on its path, it will manage to increase its revenues, lower its costs, and consequently, improve its operating income. I also believe that Roku's relations with its content partners, consumers and within will only improve as the company progresses. I further believe that the company should remain laser focused on investing in the business and growing and enhancing its products and offerings as the industry is only slated to saturate in the future.

DCF

In order to understand where I see the company in the future, I believe its pertinent to talk about how I think it will get there. Here are some of the metrics and measures that I believe are important to its success and how, I believe, they might change in the future.

- Revenue growth

- Going forward, I believe that the Platform segment of the revenue will grow in the future. I believe Roku has some semblance of competitive advantage and it should be able to leverage its current market position to increase its Platform revenue, and as the company grows, I expect the revenues to be hampered by the company's limited growth as well as increased competition. I expect Platform revenue to increase at a CAGR of 12.6% over the next 10 years from $2.9B (85% of total revenue) in FYE '23 to $9.8B by FYE '33 (79% of total revenue).

- I believe as the company grows its Platform revenue, it should also be able to sell more devices through its own platform and various partnerships with vendors across the US and globally. I expect Devices revenue to increase from $490M (14% of total revenue) to $2.6B by the end FYE '33 (about 21% of total revenue).

- Costs

- I believe as the company grows, it will continue to invest in the form of R&D and increased SG&A in order to attract the best talent. I also believe that direct costs associated with generating Platform and Devices revenue should also begin to level off where the company achieves some sense of economies of scale; this reduction and a better handle of its costs should lead the company to profitability by end of FYE '26.

- Operating Income

- As is expected of any growth company, Roku has been in the negative territory for pretty much all of its operational life. The company reported negative operating income for all of the attained years with the exception of FYE '21 when the company reported a positive operating income of $235M. I expect, with growth in revenue and reduction in costs, the company should generate positive operating income by the end FYE '26, I believe given the trends, it is well within the management grasp to turn the table in the next few years.

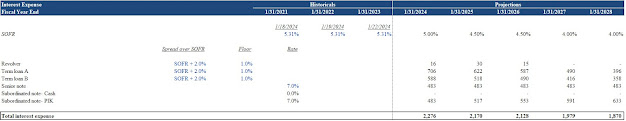

- WACC

- When I was rummaging through the company's 10K, it felt as if the management was boasting about not having any debt and a cash balance of just over $2B by the end of FYE '23, but it comes back to haunt the company's prospects when we compute its WACC. It has no debt, so it has no cost of debt, and as a result, its WACC is essentially its cost of equity, and if you were a finance major in college, you'd know that cost of equity is a more expensive form of capital than debt. At the time of the analysis, risk free rate was 4.28%, the market risk premium was 4.45%, and Roku's beta was 1.79, giving us a cost of equity of 12.25%, and given the fact that the company's has no debt other than the leasing liabilities, we get a WACC of 14.56%.

- I have chosen to keep WACC constant throughout the projection period but then used 9% for the terminal year, and the assumption there is that as the company grows, and management comes to its senses, the company should take on a more favorable capital structure; a structure that includes not only equity but also debt.

- Strategy and relations

- Going forward, I believe the management should be able to maintain its mantra of scaling, growing engagement, and improving monetization. I also believe that as the company grows, it should be able to use its existing relations with its consumers and content partners as well as improve and expand them across multiple countries.

There are multiple other factors that impact a company's valuation, i.e., capex, working capital, D&A, and innovation to name a few, the ones I have listed, I believe are generally the ones that have the significant impact on a company's future performance. With all of these metrics in, and relying on Excel's ability to calculate accurately, here is my valuation for Roku:

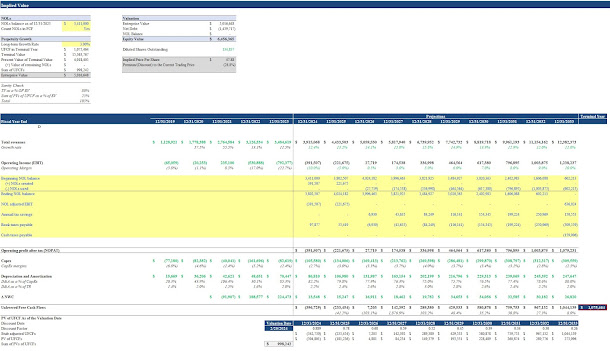

DCF Without NOLs

In case it is not legible, I get a share price of $40.84/ share, the stock, as mentioned elsewhere in this post, was trading at $67.25/ share, about 39% higher than its intrinsic value. As I have mentioned, at ad nauseum at this point, this is a growth stock and so it has, understandably, a significant balance of NOLs that shield any future income, and I decided to do a separate valuation that takes the company's net losses carryforwards into account, here is how that looks:

DCF With NOLs

As is evident from the screenshot above, if we take NOLs into account, we get a share price of $48.88/ share, a discount of 28.8% to the trading price of $67.25/ share. I guess you might think that this is very detailed and so it might be correct, but there are no certainties when valuing companies, because every inquisitive eye sees different angles and points of view, and to deal with that side of human nature, I have done the sensitivity as well as statistical analysis to deal with the uncertainty or even mistakes and errors in my judgement and assessment during this exercise.

I Don't Believe You

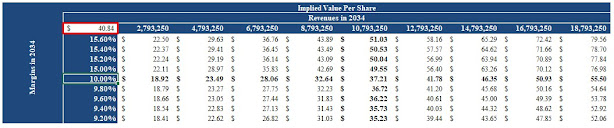

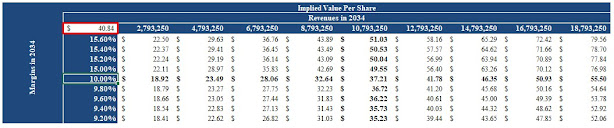

I believe that when we come up with a share price for a company through DCF, or any other method of valuation, it is prone and liable to our judgements and what we think about the company. For instance, I expect total revenues to increase to 15% in the next 5 years and then come down to 11% by the end of the projection period, and someone out there might not wholeheartedly agree with my analysis, and so to give more credence to my numbers, I have looked at some of the variables that drive a company's valuation and what the price might be given changes in said variables and drivers. Here is what the share price might be if I assume a different WACC and long term growth rate:

You can clearly see the difference if I assume a different cost of capital or a different long term growth rate. One thing that stands out is the fact that the company gets pummeled by the fact that it has no debt, giving us a WACC of 14.56%. If we assume that the company does have debt and as a result its WACC is lower than the calculated 14.56%, the price per share could be as high as $92.50/ share. Similarly, if we look at different revenue growth and operating margins in the final year, here is what that might look like:

As you can see, if we assume different margins, higher or lower, and different revenue growth rate by the end of the projection period, we get a share price that ranges from $22.50/ share to $79.56/ share. Moral of the story, it all depends on what you believe about the company and its future. My job, through my analysis and this excruciatingly long post, is to convince you of my beliefs, and to further reel you in, here is the result of 10000 unique simulations- assuming standard deviation of 2% in revenue growth, operating margins, and WACC.

The highest price I got was $158.78/ share, the lowest price per share was $15.49, giving us range of $143.11/ share. The stock's current trading price of $67.25/ share sits somewhere between the 90th and 100th percentile, not something that I am comfortable with. It is simultaneously astonishing and unfathomable to me that just a short while ago, the stock was trading in the $700/ share territory, furthering my belief that markets are rarely correct about individual stocks, they might be for all of the equities as a whole, but are unreliable on stand alone basis.

Conclusion

I believe that I am now ready to bring the prize home, I believe that Roku is overvalued and does not have the basic fundamentals or the future growth to justify its current trading price. I will not be putting it in my portfolio, at least not at this price, and you, are more than welcome to form your own opinion about the company as I have attached my Excel file for your review and dissection.

Links: