(Disclaimer: Excel file attached below the post)

Media tycoon Byron Allen, through his Allen Media Group, made another bid to take Paramount Global private. Paramount has two classes of shares trading in the public space, Class A (PARAA) and Class B (PARA); Allen Media Group offered $28.58 for each of the voting shares and $21.53 for every non-voting share- prices that are roughly 50% higher than the 90 day average of both classes of the company. Given my infatuation with valuation and private equity transactions, I decided to first value the company, and then look at the LBO transaction and assess whether or not Paramount Global has the basic fundamentals to handle the new debt that this transaction might imposed on the company's balance sheet. I have a lot to go over and so I will refrain from going down my usual rabbit hole, and instead will briefly talk about the company's business model, and then move onto the analysis.

Business and Operations

Paramount is a global media, streaming and entertainment company that creates content and experiences for consumers worldwide. The company's portfolio includes CBS, Showtime, Paramount Pictures, Nickelodeon, MTV, Comedy Central, BET, Paramount+, and Pluto TV. Paramount prides in the fact that at the end of 2023, the company had one of the most enriching and extensive libraries in the industry. The company's strategy is rooted in three fundamental tenets: Broad and varied content, multiplatform distribution model, and the company's global reach and presence.

2022 was a remarkable and a notable year for the company. The company saw its global steaming subscribers grow 38% YOY to 77.3 million and Paramount+ subscribers grow 70% YOY to 55.9 million; the growth was majorly driven by critically acclaimed titles such as Halo, 1923, Tulsa King, and Orphan: First Kill. According to Antenna, Paramount+ is the number one streaming service in terms up domestic sign-ups and subscriber additions since the platform's inception in March '21. The company also enjoyed from having released multiple films that ended up not only being critically acclaimed but also raking in billions for the company; think Top Gun: Maverick, Scream, Jackass Forever and The Lost City.

The company operates through the following three segments:

- TV Media

- TV Media consists of the company's broadcast operations, the domestic premium and basic cable networks, including Paramount Media Networks, Nickelodeon and BET, and domestic and international television studio operations including CBS Studios, and Paramount Television. TV Media's revenues are principally generated by advertising, subscription revenues, and various other fees associated with distribution and creation of content. TV Media's revenue has been a significant chunk of the company's overall topline; 72%, 80%, and 83% of the consolidated results in '22, '21, and '20, respectively.

- Direct to Consumer

- This segment consists of the company's domestic and international portfolio of pay and free streaming services, including Paramount+, Pluto TV, Showtime Networks and Noggin. This segment's revenues are comprised of advertising and subscription revenues generated by the company's offerings. This segment generated 16%, 12%, and 7% of consolidated revenues for "22, '21 and '20, respectively.

- Filmed Entertainment

- The Filmed Entertainment segment consists of Paramount Pictures, Paramount players, Paramount Animation, and Nickelodeon Studio. The segment produces and acquires films, series, and short form content for release and licensing in the USA and around the world. Filmed Entertainment generated 13%, 9%, and 10% of the company's consolidated revenues in '22, '21, and '20, respectively.

With a sound understanding of the company's operations, lets move onto what I think about the company's future and what its true intrinsic value is according to my forecasts.

DCF

Having gone through the company's business operations, and how much each of the segments contribute to the overall health of the company, I think I am ready to move onto the company's valuation. The company reported revenues of $30B, $29B, and $26B for FYEs '22, '21, and '20, respectively. The last reported revenues witnessed growth of 5.5%, down from 13% for the preceding year. Company also reported operating income of $2.3B, $6.2B, and $4.1B for FYE's '22, '21, and '20 respectively. Going forward, I expect the company's revenues to grow at a CAGR of 5.8%, from $30B in FYE '22 to $40B in FYE '27. I expect the growth in revenues to be driven by company's heavy presence in all aspects of the entertainment industry, as well as its solid position in the production of lucrative films, and increase in its subscribers across all platforms due to aggressive growth and expansive strategies. The increase in revenues, I expect, will allow the company to yield an increase in its operating income, from $2.3B in FYE '22 to $4B in FYE '27. I expect the increase in operating income to be driven from not only revenues but also the management's ability to curb its costs and expenses associated with its operations. Given the nature of the company's operations, I expect the change in NWC to increase over the projected years, giving us a cash outflow; I also expect the company to keep investing in its business such that D&A is roughly around 98% of capex by FYE '27.

As with all of my valuations in the current microeconomic environment, I expect the company to grow at a rate of 2% in perpetuity, further explaining my reinvestment thesis going forward for the company. My calculated WACC for the company, given its current debt to equity ratio, is 6.93%. With all of these assumptions in line, here is the value I get for the company.

DCF

Based on my assumptions, and what I think about the future of the company, I get a price per share of $13.37 for class B (trading at $14.03) and $20.93 for class A (trading at $21.96) shares. Allen Media Group offered $21.53 for class B shares and $28.58 for every class A share; class B offering price represents a premium of 61% over the intrinsic value, and class A shares' offering price yields a premium of 36% over the intrinsic value of $20.93. Based on the company's internal growth prospects, risk involved in its businesses and offerings, its projected cash flows, and the projected reinvestment, I believe Allen's offering price for both the classes of shares is a decent deal. I further believe that the management is holding on to the hope that the price per share might once again touch $50/ share, but I do not see that happening; and so rejecting a deal based on that hope might prove to be futile.

In order to further understand the company's intrinsic value and what it might be under different operating circumstances, I decided to run the usual scenario analysis. The prices per share mentioned above are in my base case. The picture, as one would expect, is different under best and weak cases. My best case scenario gave me price per share of $24.11 for class B and $37.74 for class A; my weak case on the other hand, gave me a price per share of $11.71 for class B and $18.33 for class A. As mentioned before, it seems like a fair deal, and the management could, of course, ask for more, they wouldn't be fulfilling their fiduciary duty if they didn't, but as it stands, the deal seems like a legitimate offer to entertain. Lets now look at what this transaction might look like, whether the company can service the new amount of debt, and what the returns might look like for various lenders, sponsor and Paramount's shareholders.

LBO

Allen Media Group's offer price for both of Paramount's classes translates to an offer value of just over $14B, and including Paramount's outstanding debt, the total transactional value ends up around $30B. Before I go any further, I am not sure if Allen Media Group intends to keep the company in its portfolio since it is a "Media" group, or if it intends to sell the company down the road, either way, I wanted to see if Paramount could afford the debt that is about to be piled on it; and what better way to analyze a company's ability to service its debt than an LBO analysis? Here here are my transaction assumptions:

Sources and Uses

Quick Analysis

I am assuming the total transactional value of the deal to be roughly around $33.9B, that includes the buyout of equity for $14.5B, refinancing of Paramount's old debt in the amount of $16.9B (including lease liabilities), and various transactional and financing fees. My proposed EBITDA multiple is 8.62x, and given the size of the deal, I think the acquirer will end up subscribing to various tranches of debt, including a revolver, term loans, senior notes, and some form of subordinated debt; I am further assuming that Allen Media group will end up using a sizable portion of Paramount's cash balance in its sources of funds. Here is what I think the income statement would look like for the next several years.

Income Statement

If the Allen group operates the company in its current conditions, I believe in base case, Paramount could increase its revenues from $30B in FYE '22 to $46.9B in FYE '27, along with total costs and expenses of $39B in FYE '27. I am also assuming, as is evident from the screen shot, that given the possible cost and capex synergies, the new owners might be able to reduce costs to about 83% of total revenues in FYE '27, down from 92% in FYE '22; I further expect the company to generate operating income of $7.4B by FYE '27. Given the amount of debt that I am presuming for this transaction, the non-operating expenses- namely interest expense and interest income- is where it gets interesting. I am sticking around $32B of debt on the company's balance sheet, including all tranches of debt, and with the most basic assumptions, I think the interest expense going forward for the company will be around $2.3B on an annual basis, company reported interest expense of $931MM, $986MM, and $1B for the FYEs '22, '21, and 20, respectively. So the question is, can the company afford this level of debt, and I think that it can, as my projections- along with the interest expense associated with all the tranches- show me an increase in net income from $246MM in FYE '23 to $4.6B in FYE '27. I mentioned the EBITDA multiple at the beginning of this part of the post, and so I think it is only pertinent that I mention what the adjusted EBITDA might look like five years down the road.

Adjusted EBTIDA

My entry EBITDA of 8.62x was derived from the company's reported adjusted EBITDA of $3.4B, and going forward, I believe given the company's operations and place in the industry, the new owners will be able to inflate that figure to $9.6B by the end of FY '27. Here is what I think the going forward cash flow statement might look like:

Cash Flow Statement

I expect the company to have healthy cash flows from operations and decent free cash flows throughout the projected years. Given the healthy cash flows, and being that this is a leveraged buyout analysis and not M&A or accretion/dilution analysis, I am also assuming that the company might opt to use 50% of excess cash to try reduce the debt balance throughout the projected years. Here is what I think the cash balance and different tranches of debt might look like for the next five years:

Tranches of Debt

As you can see, I expect the company, along with being able to service its new debt, to pay off a sizable portion of its term loans if it wanted to. If the new owners do end up deciding to pay off the debt, I expect the company's total debt balance to be $27B in FYE '27, down from $32.7B at the time of the transaction. Here is what the interest expense could be for all portions of the debt (with my assumptions about SOFR and the yield on all the tranches):

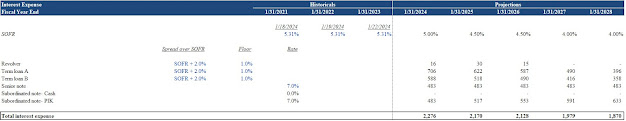

Interest Expense

I have also done the returns analysis, assuming that this is a PE transaction, but have chosen not to include that portion of the model in the post, simply because I did not see it being accretive, but rest assured, the returns analysis is in the Excel file attached below the post.

Conclusion

As I said at the beginning of the post, this is a fairly new transaction, last I read was that Allen's team reached out to Paramount's various directors and have not gotten a response as of the timing of this post, and I have approached this as an LBO transaction, which I, personally, believe is the best form of analysis when analyzing debt and a company's ability to service its obligations. For all intents and purposes, I think, again, that this a fair deal for Paramount's shareholders as well as Allen Media Group's broader goal of culminating various media and entertainment platforms under its omnipotent umbrella.

Links

No comments:

Post a Comment