(Disclaimer: Excel file attached below the post)

I recently came across one of Crocs' brick and mortar locations here on Long Island and, given how much of the marketing material I have seen, I was tempted to give it an opportunity to earn my patronage, and so I went in and bought myself one of its sandals. The design was unique in how it looked, the thick sole, rugged look, and completely matte-black visage seemed enthralling, and given its design and look, we picked two pairs thinking that the price couldn't be that high, right? Well, it cost us a little over $100 for two simple looking sandals/slippers. I was surprised to say the least, but we were at a point of no return, so we went ahead and checked out; but as I was walking out, I started thinking about the company and the massive variety of uniquely designed shoes/sandals/slippers that were hanging on the racks and sitting on the shelves, in some cases, even dressed and presented in a way that one would see in a Gucci or some other high-end store. I decided right there and then that now that I have interreacted with the company to some extent and have seen first hand how its stores look and are designed, I was going to value the company and assess if it was appropriately priced or not. So here it goes.

Crocs (CROX)

Crocs is known for designing, developing, marketing, selling and distributing its uniquely designed casual footwear for all; company's innovative approach and truly idiomatic looking shoes, sandals and slippers have made it popular among consumers that want a product that is not only casual, but is highly individualized and almost perfect for day to day activities and usage. On Feb 17, 2022, as a part of the company's growth strategy, Crocs acquired 100% of equity of a privately-owned casual footwear company named "HEYDUDE." Ever since the acquisition, Crocs has expanded and grown the brand and installed their leadership team at HEYDUDE. As a result of the transaction, company now reports revenues for two different segments: Crocs Brand and HEYDUDE Brand.

Crocs brand is known for its inviolable and unmistakable iconic molded clog silhouette; the company has managed to adopt the successful formula of a simple design aesthetic paired with modern comfort and have applied it to a wide variety of footwear products including sandals, wedges, flips, and slides that meet the specific needs of customers across the whole spectrum. Crocs uses Croslite for a majority of its offerings, a revolutionary and proprietary technology that gives its shoes the soft, comfortable, lightweight, non-marking, and odor resisting qualities that its customers have come to know and absolutely adore. HEYDUDE brand, on the other hand, offers shoes with a versatile and omnipotent design that revolves around personalization, casualization, functionality, and most important of all, comfort.

Distribution Channels

Over the years, Crocs has expanded its brand and presence to markets across the world; as of the writing of this post, Crocs operates and distributes its products in more than 80 countries through two distribution channels: wholesale and DTC (Direct to Consumer).

Wholesale Channel

Wholesale channel includes domestic and international multi-brand retailers, mono-branded partner stores, e-tailers, and distributors. Wholesale channel distributions accounted for 52%, 54.9%, and 50.8% of the company's consolidated revenues for FY '23, '22, and '21, respectively. Wholesale channel utilizes the company's relationship with wholesalers and retailers of all kind that operate under contractual agreements to ensure efficient and seamless distribution of Crocs' products and offerings.

Direct to Consumer Channel

DTC includes company operated e-commerce sites, third-party marketplaces, company operated retail stores, and outlet stores. Direct to consumer channel accounted for 48%, 45.1%, and 49.2% of the company's consolidated revenues for FY '23, '22, and '21, respectively. As of the end of FY '23, company offers products through 16 company-operated e-commerce sites worldwide and also on third-party marketplaces. Crocs' e-commerce and online presence facilitates a greater connection with its consumers worldwide, and is aptly able to meet their demands and enhance its own brand value through its sites. Company engages in sophisticated and complex digital marketing strategies to retain its current consumers as well as acquiring more customers; this trend also enables the company to stay on par with consumer preferences and benefit from the ever increasing migration of consumers to online shopping.

The management isn't only focused on online and e-commerce business, but is also equally vested in maintaining and improving its current fleet of retail stores. As of FY '23, the company had 349 Crocs' locations and 14 company operated HYDUDE stores. Brick and mortar locations allow the company to showcase its new shoes in their full glory and entice gullible consumers such as myself to walk in and experience the opulence and be a part of the revolution. Stores also allow the company to sell its discontinued and overstocked merchandise at discounted prices. Company's kiosk/store-in-store locations allow the distribution and dissemination of the company's products with flexibility in shopping malls and other high-foot traffic areas.

FY 2023 Operational Highlights

Consolidated revenues for FY '23 were $3.9B, an 11.5% increase when compared to the reported revenues of $3.5B for FY '22; the increase in revenues was due to higher average selling prices (explains why I paid more than $100 for two sandals), higher sales volume, and lastly, due to the consolidation of HEYDUDE's revenues. The company sold 119.6 millions pairs of shoes worldwide for the Crocs brand (an increase from 115.6 million sold in FY '22), and 33 millions of pairs for the HEYDUDE brand, in total, that is ~$26 for every pair across both brands.

Company reported gross margins of 55.8% compared to 52.3% reported for FY '22; gross margins for the Crocs brand was 60%, an increase of 3.70% YOY due to higher ASP and other factors such as air freight costs and supply chain disruptions due to ongoing conflicts and events. Gross margins for the HEYDUDE brand was 44%, an increase of 3.20% over the last recorded partial gross margins in FY '22. SG&A expenses were $1.2B, an increase of $154.4M YOY due to investments made in talent and marketing as the company continues to grow its business as well as expanding HEYDUDE's range and proximity to other geographies. Company reported an EBIT of $1.04B, a 21.9% YOY growth and margins of 26.2%. Here is a snapshot of the company's operations for FY '23 and the comparison to numbers reported in FY '22:

- Improving digital sales: As mentioned before in this post, one of the distribution channels that the company uses is DTC (Direct to Consumer) and a sub-organ of that channel is sales and distribution through digital channels such as the 16 company operated e-commerce sites; I think that going forward, this could prove to be an avenue of significant growth for the company. Digital sales accounted for 37.9%, 37.8%, and 36.7% of consolidated revenues for FY '23, '22, and '21, respectively; I believe that more investment and a focus on marketing specifically catered to consumers that prefer online shopping could boost the company's consolidated online sales.

- Gaining more market share for Crocs: Crocs is already well known within its industry in terms of market share and its unique design, and I believe that the company is only getting started, and that as the company grows, it should be able to attain more consumers through its marketing, investments, and innovatively unique products.

- Increasing awareness and distribution of HEYDUDE brand: As mentioned before in the post, Crocs acquired HEYDUDE, a privately owned business, in 2022, and that presents a monumental avenue of growth for the company. I believe with the right decisions and investments, the company should be able to expand the HEYDUDE brand both in national and international markets; additionally, Crocs' already established brand and intricate network of warehouses and distribution centers and partners should help HEYDUDE become as common, trusted, and adored as the Crocs brand, thereby contributing to the growth of the company's consolidated top line.

- International growth: Crocs operates in over 80 countries through its wholesale and DTC channels, and I believe that there is enormous potential of growth where the company could expand to other favorable geographies as well as expanding its pre-existing distributing partners and network.

- Innovation: Crocs, I believe, already spends a huge chunk of its cash on innovation, and I know that because, as mentioned earlier, I had the misfortune of walking into one of them, and I was thrown back by the amount of variety and designs of shoes, sandals and slippers. I especially admired the charms that they allow consumers to tag onto their shoes, similar to what Pandora does for bracelets, making the shoes truly unique and individualized. I expect this sort of innovation to continue as I trust that it will help the company grow as well as assist in keeping things intriguing and not loosing their customers through iterative and recycled designs.

- Better cost structure: I believe as the company moves forward, it should be able to maintain a stable cost structure along with increasing their revenues. This reduction in costs should help the company with improving and maintaining industry leading margins.

- Playing safe with supply chain: Crocs operates- and by that I mean sources its production and distributes- globally and that presents its own macro challenges that the management will have to keep an eye on. The company is already suffering from headwinds caused by supply chain disruptions due to COVID, not to mention other globally disruptive conflicts, in the forms of high freight costs, congestions and port closures, and I believe that the company will have to diversify its supply chain going forward and try to reduce the risks associated with their supply and distribution chain.

- Brand ambassadors: Crocs already has well established relationships with businesses and various influencers, and as the company grows and the impact of social media grows on consumers, I believe Crocs will have to engage in brand ambassadorship with celebrities and influencers in order to maintain their control and improve their growth in the future.

- Revenue growth: I expect the company's revenues to grow at CAGR of 11.2% over the projection period. If you look at the YOY change in revenues, I am not assuming over the top growth as I don't think that the company can achieve or even sustain high double digit growth, and so I expect as the company moves on, consolidated revenues to grow gradually from 11.5% in FY '23 to 13% in FY '28. Furthermore, I expect once at 13%, the growth should start to taper off and end the projection period with 8% YOY growth. I believe that given the fundamentals and future potential avenues mentioned above along with the latest acquisition of HEYDUDE, Crocs should be able to achieve my revenue growth assumptions and expectations, if not exceed.

- Operating income and margins: Company reported an operating income of $1.04B and operating margins of 26.2% for FY '23; I expect the company's margins to improve over the next five years where they should be around 30% by the end FY '28, and as the company grows and moves along the corporate lifeline, I believe the margins should decrease from 30% in FY '28 to 25% by the end of FY '33. I believe that my margins expectations are in line with the industry, and I believe that Crocs has the potential to reach 30% margins over the next 5 years due to strong brand recognition, constant innovation and diversification of its products, inorganic activities such as the HEYDUDE acquisition, an established production and distribution network that is only poised to improve, future investments in its online and retail businesses, potential brand deals with celebrities and social media influencers driven by efficient marketing, and lastly, consumer loyalty that stems from the brands unique, comfortable, and personalized approach.

- Costs: I believe that as the company continues to grow and improve its operations, its costs, both direct and indirect, associated with revenues should decrease, further explaining the assumptions around margin improvements. I believe that as the company grows, it should start to claim pricing power due to its uniqueness, it should also start to have more sway with its producers and distributors, witness lower CAC, and just have a better overall grasp of its SG&A and R&D costs.

- Taxes: Company's last reported effective tax rate was 9.6%, which is significantly lower than the marginal tax rate of, I believe, 25%, and so I am assuming that as the company moves along the projection period, the effective tax rate should incrementally merge with the marginal tax rate.

- Capex: Crocs' reported $116M in capex or margins of 2.9% for FY '23; I am assuming that the growth in capex should be directly proportional to the increase in revenues, and so going forward, I expect capex to increase from 2.9% in FY '23 to 3.5% of consolidated revenues by FY '28, and as revenues start to taper off, so should capex, to 2.5% by the end of FY '33.

- D&A: Company reported D&A of $54M (D&A margins of 1.4% and D&A as a % of capex of 47%) for FY '23; going forward, I believe as the company invests in property, plant and equipment to fund its future growth, D&A should start to increase as well, I am further assuming that D&A should be around 90% of capex by the end of the projection period. I am not assuming 100% because that would mean that the company isn't growing but just replacing its old assets, and so that would nullify my growth in perpetuity of 2%, if I am assuming a growth in perpetuity, the company continually needs to invest in perpetuity to support that growth.

- Net working capital: Company reported NWC margins of 3.8% for FY '23, and given the volatility and ginormous uncertainty around working capital items, I am straight-lining it for conservatism's sake.

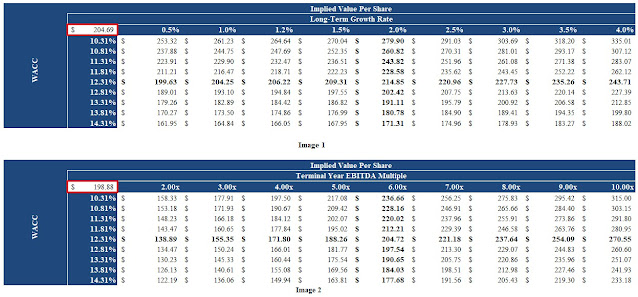

- WACC: For pre-tax cost of debt, I rummaged through the company's 10K and found a footnote outlining the company's outstanding debt, and I decided to take the weighted average of all of the company's prior debt and use that as my pre-tax cost of debt, which was 4.19%, and 3.14% after tax. Company had a beta of 2.02, risk free rate as of this post was 4.65%, and market risk premium was 4.13%, giving us a WACC of 12.71%.

- Additional risk premium: Having done my research into the company and its operations, I am tagging an additional risk premium of 2%. I think that it would be safe to assume that the company is highly susceptible to not only its consumers' spending behaviors but also to the global conflicts given its production and distribution channel and supply chain. Additionally, I believe that the company has some fraction of risk involved given its size at the time of this post; and so adding an additional risk premium to the company's WACC I think completely encompasses all business and economic related risks.

- EBITDA multiple: I am not a huge proponent of using the EBITDA multiple approach when valuing companies through an intrinsic valuation method such as the DCF because it brings in market factors and assumptions into the equation which is the polar opposite of what a DCF is; nevertheless, to justify my valuation, I decided to use the multiple approach purely for sanity reasons. My implied EBITDA multiple through the perpetuity approach is 6.37x, and to be safe, I am assuming a multiple of 6x for the EBITDA approach. This is purely conjecture because EBITDA multiple is typically derived from analyzing other companies and the multiples that they are trading at, and given that I do not have access to any of the databases or financial services companies such as CapIQ and FactSet, it is simply impossible for me to do that, hence my assumption.

As is evident from the distributions of the share price, given my assumptions and the assumed standard deviations, most of the values lie between $172-$218/ share range. The median price per share of the simulations was $204.00, which is nearly identical to the DCF derived value of $204.69 per share; moreover, the DCF derived price per share is within the 50th and 60th percentile of the values. Additionally, the stock at the time of this analysis was trading at $127.69 per share, which is less than the 10th percentile of the values.

No comments:

Post a Comment