(Disclaimer: Excel file attached below the post)

DocuSign has been making strides in the financial world because of Bain and Hellman & Friedman's attempt to take the company private. The deal is still in its introductory stages, and so I was not able to ascertain the offering price, value or even the offered EBITDA multiple given my limited resources. I did, however, come across an article discussing $8B in funding that the investors are seeking, and so I am basing my analysis on that one number alone. This is an educational and hypothetical experiment to solely satisfy my personal curiosity. As is the norm with my posts, I'd like to start off with the company's historic performance, both on a standalone basis and compared to its close competitors as well as some of the most followed indices; I'd like to then move on to the company's business model and its operations, and finally end it with the LBO analysis and what the returns might look like five years down the road.

DocuSign- Past Performance

DocuSign- Historic Share Price and Volume

DOCU had its IPO in April 2018 at an offering price of $29/ share; stock debuted at $38/ share and held its ground throughout the day. The company sold 21.7 million shares at its public offering and raised $629.3M, bringing its total shares outstanding to 152.1 million at that time. The chart above is pretty self-explanatory in that the stock is relatively stable with the exception of the period encompassing the breakdown. The share at one point during the pandemic was trading around $300/ share, the monumental jump is not surprising when you ponder on the company's business model and its directly proportional relation with the consequences of worldwide lockdowns. DOCU, as I am pretty sure you know, offers applications and software for e-signing contracts and making the process as frictionless as possible; during the lockdowns, when consumers and businesses were unable to conduct their operations in person, everyone relied on companies such as DOCU and Adobe to offer alternative avenues for the entire journey of the contracts: from drawing up papers to tracking various stages of the process and finally signing the papers in the luxury of their own homes. DOCU, along with myriad of other equities and sectors, saw this exponential boost that everyone thought would remain; alas, that was not the case. The stock plummeted soon after things started to get back to normal; personally, I think it is back in the price range where it belongs because without even conducting a valuation, I can say with a fair amount of certainty that the stock is not worth the price tag that it traded at for those couple of years. Lets now move on to how it has faired against some of it competitors.

DocuSign Vs. Comps

DOCU, for the most part of its existence in the public sphere, has been trading on par with its compatriots; the company, along with its competitors, saw the Corona boost we talked about earlier, but unlike most of its close comps, it has not been able to maintain or even attempt to claw back up to its glory days. One of the reasons could be that the company has not been able to maintain its expected growth or even consumers and number of contracts it attained during the pandemic, or that it lost its competitive advantage, or it could also be that other companies such as Adobe and Dropbox have chewed away some of its potential. Lets now compare the company to three of the highly followed indices: S&P 500, Russell 3000, and the Nasdaq.

I believe, even without being an expert on the company or its sector and sub-category, one could clearly see the implausible growth and attraction attached to the company; I am not dumbfounded, even in the least, at the stock's downfall. I believe that on one hand, pandemic reeled in the lofty, unsustainable, and unjustifiable valuations to reality, but on the other hand, it pumped adrenaline into other undeserving equities, but I guess such are the tantrums of the market. Having gone through DOCU's past performance, the next likely stage to delve a little deeper into is its business model and operations; because I believe it is paramount that we understand the business before we can move onto the LBO analysis.

DocuSign- Business Model and Operations

DOCU is one of the leaders in the e-Signature category. The company offers products and services to not only smoothen the signing stage of the process but also to make other steps along the way as convenient as possible. Its offerings, along with its e-signature product, enable agreements and contracts to be signed electronically on a wide variety of devices, rendering it virtually accessible in 180 countries. Its applications help with the automation, auto-generation, and tracking of agreements and contracts for individuals, small businesses, and major corporations and enterprises. Its value proposition, as its 10K states, is simple, "...eliminate the paper, automate processes, and connect to the applications and systems where work gets done. This allows organizations to reduce turnaround times and costs, largely eliminate errors, and deliver a streamlined customer experience." As of Jan 23, company's services were being used by 1.3 million users across 180 countries around the globe.

DOCU prides itself in the benefits that its platform and services offer. The company believes that its differentiation is driven by its stringent security standards, high availability, simplicity in its usage, the fact that it is developer friendly, high auditability, and its global presence. The company's offerings allow its customers to conduct their respective businesses faster by replacing manual paper driven processes with automated digital workflows. The company offers following key products:

- DocuSign eSignature

- Main product, enables sending and signing of agreements and contracts on a wide variety of devices

- CLM (Contract Lifecycle Management)

- Allows workflows across the entire agreement process. It provides organizations the flexibility to automate complex processes for generating, negotiating, and storing agreements

- Gen for Salesforce

- Allows sales representatives to automatically generate polished, customizable agreements using Salesforce

- Identify

- A group of applications that are used for enhanced signer-identification options

- Standards- Based Signatures

- Supports electronic signatures that utilize digital certificates, including those specified in the EU's eIDAS regulations for electronic signatures

- Monitor

- Uses advances analytics to track DocuSign eSignature web, mobile, API account activity across the customer's organization

With a somewhat solid understanding of the company's operations and its business model, lets move on to the LBO analysis.

LBO

If you are reading this post, I am assuming that you are somewhat familiar with the PE industry and how LBOs typically work along with the related financial jargon. Nevertheless, I would like to take a few minutes and discuss the usual drivers for an LBO. The first one is the insane amount of debt that is levied on the portfolio company, and so investors typically look for companies with stable cash flows; please, don't confuse negative EBIT or NI with cash flows. Additionally, debt is a cheaper form of credit because unlike equity owners, companies only have to pay interest and balloon payments whereas equity holders get a piece of the pie. So one of the main goals is to use the company's excess cash flows to deleverage as quickly as possible throughout the holding period. Second driver would be top line growth and expansion. The expectation is that the company will be able to either maintain its current growth trajectory or expand its market share. The third drive is the reduction of costs, both COGS and other operating expenses such as R&D and SG&A. The reduction in costs will translate into higher gross profit and margins and, consequently, higher cash flows. The fourth driver is the expansion of EBITDA. LBO transactions are typically made in one of two ways: one is when a company is publicly traded and investors offer a price per share, and the other is when the company is privately held and so the transaction takes place as a multiple of EBITDA, our case would be the offering price per share. Lastly, better asset utilization, which means that the new owners will manage to find a way to better control working capital and the deployment of fixed assets. With the understanding of the typical drivers of an LBO, lets move onto our analysis. Below is a snapshot of my assumptions.

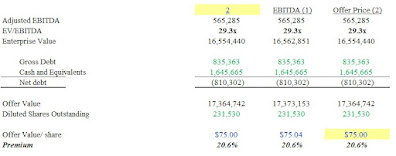

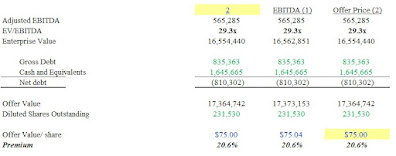

As stated earlier in the post, the deal is still in its infancy at best, and so I went ahead and assumed that Bain and Hellman & Friedman will offer a premium of 21% or $75/ share over the stock's price of $62.21 as of this analysis. The offer price gives us an offer value of roughly $17B, which given DOCU's net debt of -$810M, yields an enterprise value of $16B, giving us an EBITDA multiple of 29.3X. DocuSign also has cash and cash equivalents of $1.6B and I expect the investors will use a huge chunk of that cash balance- $1.3B to be exact- to partially offset the debt they'll have to take on. I have additionally assumed the investors will take on term loans A , B, and Senior note of 6X EBITDA, along with Subordinated note of 5X. Lastly, I have assumed transaction fees to be 2% of the offer value and financing fees of $842M for the transaction. Lets move onto the forward looking income statement.

Starting off with revenues, DOCU reported revenues of $1.4B, $2.1B, and $2.5B for the FYs '21, '22, and '23, respectively; with growth of 45% from FY '21 to FY '22, and 19% from FY '22 to FY '23. In my base case, I expect the new owners and investors to maintain a steady growth rate throughout the next 5 years; from 21% in FY '24 to 25% by the end of FY '28. I believe the growth in revenues will be driven off of several factors: the company's brand, its existing customer base, ability to acquire new customers, expand to other locales and geographies, and finally investing enough to not only enhance its existing products and services but also invent new ways of penetration into other parts of the industry. The company also reported costs of revenue margins of 25% (FY '21), 22% (FY '22), and 21% (FY '23). Costs of revenue consist of costs for subscription and costs for professional services and other; as a result, I expect the costs to settle somewhat around the same level, 22% of the total revenues in FY '28. I am not expecting a huge reduction in these costs because of their nature, and as the business grows, I expect these costs will grow in line with revenues. The next line items are the operating expenses: R&D, SG&A, and Restructuring and other. Upon inspection of its income statement, it is abundantly clear where most of its revenues dissipate to. Company reported operating expenses of $1.2B, $1.7B, and $2.1B for FYs '21, '22', and '23, respectively, with margins of 86.9% (FY '21), 80.8% (FY '22), and 82.2% (FY '23). Given the nature of the transaction, I expect the new owners to be able to gradually bring down the operating expenses over the next two years where they are only 58% of the total revenues; this might be harder said than done, but it could be achieved with the advent of new technologies such as AI, and reduced headcount. Additionally, I got an adjusted EBITDA of $565M for FY '23- I am slightly off from what the company reported because it is hard to nail down exactly what is recurring and what is the normal course of business. With all of my assumptions in line, here is what the going forward cash flow statement looks like:

Going Forward Cash Flow Statement

The company clearly generates healthy amount of cash flows; my projections show $158M in FY '24 to $1.9B in FY '28. Free cash flows easily allow for mandatory debt amortization, with the exception of first year where I project the company might need to draw on its revolver, but then is able to completely pay off the revolver by the third year, and start to make additional discretionary payments for proposed term loans A and B. Delving deeper into debt service, my model shows me that with the company's operations and free cash flows, new owners, along with making mandatory debt payments for different tranches of debt, will be able to make discretionary payments starting from year 3 and bring down the term loan balances to $1.17B by year 5. Here is what the exit might look like given my transaction and operational assumptions:

Exit Analysis

Assuming the same entry EBITDA multiple at exit, I get an equity value of $57B, a monumental increase from the initial offer value of $17B. If for some reason the owners aren't able to get the same EBITDA multiple at exit, the equity value is still pretty significant even for 26X or 28X EBITDA. On the upside, an exit multiple of 34X gives us an offer value of $66B. Lets look at IRR and MOIC for the assumed lenders and equity sponsors:

As is clear from the analysis, all of the lenders and equity sponsors are projected to get healthy amounts of returns. What stands out is the equity owners' IRR at various EBITDA multiples. If we take our conservative assumption and assume that the owners will be able to exit at 30X, that translates into an IRR of 63%, way above, I believe, any PE firm's hurdle rate. The IRR is 57% even if the investors exit at 26X; I could clearly see the attraction to take DOCU private. One more analysis that is typically done in LBO analyses is to look at the range of offer values given investors' different rate of returns.

If we assume a 30% rate of return, which is typically the norm in PE industry, the investors can manage to offer $27.8B in equity value, yielding an offer price per share of $120, a premium of 93% over $62.2/ share1. You can look at other numbers and just marvel at how lucrative and beneficial this deal could be for the lenders, equity sponsors, and DOCU's shareholders.

Forest For the Trees

As is the case with valuations and analyses of these kinds, it is easy to loose sight of what truly matters. For all intents and purposes, the transaction looks like a solid deal, but what could it mean for DocuSign's existing shareholders? The stock's offering price at the time of its IPO was $29/ share, it is now trading at around $62/ share, I think the deal with a premium of around 25%-30% could prove to be very profitable for its existing shareholders. Shareholders that are hoping against hope and waiting for the stock to reach its pandemic driven high of around $300/ share (or even to cross $100/ share) or anywhere near that vicinity, might be in for a rude awakening.

Note: All numbers in this post are based on my base case.

Links:

No comments:

Post a Comment